Conserving Young To Avoid Adult Financial Obligation And Absence Of A Retirement

Conserving Young To Avoid Adult Financial Obligation And Absence Of A Retirement

Blog Article

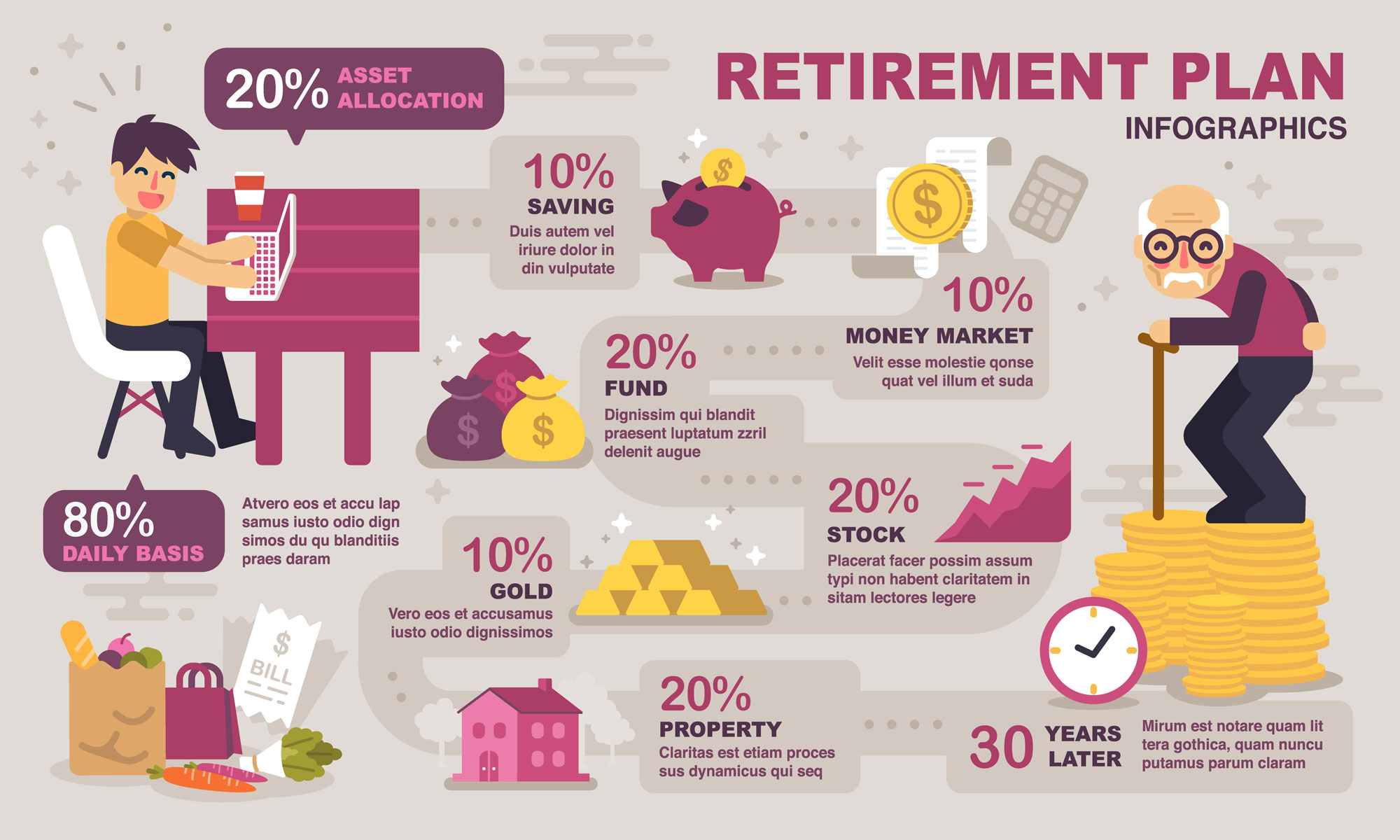

It is normal to consider retirement, have some doubts and concerns, when one nears that age. Some might even begin thinking about retirement early. Nowadays with working lives being so extreme and stressful, retirement is invited for the time it gives unwind and take pleasure in. On the other hand for people who like to be occupied all the time, retirement can bring in doubts regarding how to spend one's totally free time. All these are a part of retirement preparation. And it is a must to start considering retirement preparation while one is still employed and working. Specifically it is recommended to be clear about the financial aspects after retirement, about having a particular monetary strategy.

By keeping tabs on your costs you will discover how much, typically, it costs you to live. This will assist you see if you are saving enough to preserve your lifestyle in retirement and, if not, what you can do to repair the issue.

Now that you are aware of it, why not make your dreams come true? To make your dreams become a reality, you should have a concrete strategy. A dream without a plan is simply a simple dream. So make your dreams happen!

John & Mary live retirement planning a life of luxury-- John, 56, and Mary, 52, play golf every early morning, sit by the pool in the afternoon, and take pleasure in fantastic shows in the evening. The very best part is that they are not rich at all. They have just used some economical early retirement planning that permits such an early retirement way of life.

Rather of fearing losing their money, women actually NEED TO concentrate on whether they will run out of money. Siegel said that this ought to be their biggest fear instead.

Planning for your retirement may appear too far in the future however it can be here before you know it and the earlier you start saving the better off you'll be when it slips up on you.

(ii) E-trade- E-trade has been ranked as one of the most reputed online brokerage. Apart from individual retirement account services they likewise use other banking services. They offer $9.25 stock bonds and exact same as Scott trade has no account costs or minimum balance restrictions.

This simple example plainly reveals that preparing for retirement should begin early. It becomes more difficult the longer you leave it. Make the most of your 401k plan through your employer if in the U.S.A., begin a KiwiSaver scheme in New Zealand. Wherever you live, prepare for retirement and start conserving now!